Award-Winning Customer Support

CQG provides extensive on-site training to implement CQG's risk management system and CAST. We also provide around-the-clock service to our FCMs. Our dedicated FCM Desk is staffed by our most senior support personnel who are experts in CAST as well as in trade routing. Our customer support team operates from ten locations across the globe and strives to exceed customer expectations twenty-four hours a day. CQG's customer support is backed by product development staff in four countries, product specialists, and data quality and operations teams.

Trade Routing Tools

The fastest order routing solutions for traders at proprietary trading firms, hedge funds, financial institutions, CTAs, and FCMs

Global Connectivity and Direct Market Access

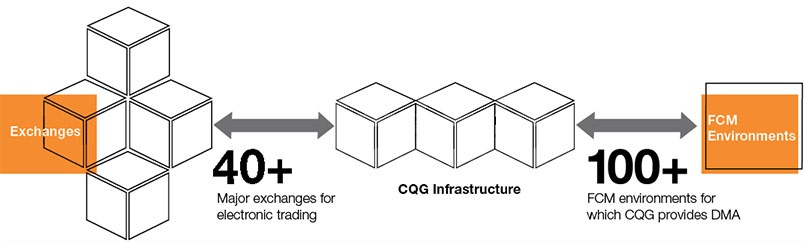

CQG delivers Hosted Direct Market Access to exchanges around the world. CQG is connected to over seventy-five market data sources and more than forty exchanges for electronic trading. Buy side or sell side, forex or futures, equities or energy, foreign or domestic, CQG connects you to the markets.

Turnkey Enterprise Solutions

CQG's trading solutions are easier to deploy, require less capital investment, are less expensive to maintain, and deliver marketleading performance and reliability. CQG-operated market data and exchange networks reduce your overhead. CQG's risk engine gives you maximum control over customer accounts. Ease and speed of implementation and dedicated CQG support increase your operational efficiency.

Server-Side Speed

CQG's server-side tools eliminate the impact of geographic latency to give traders optimal order execution. Spread orders, orders into aggregated markets, and smart orders are managed on CQG servers co-located with exchange matching engines. CQG installs state-of-the-art servers and network equipment that is monitored around the clock, ensuring an optimal experience trading complex strategy orders.

Sophisticated front-end tools and smart order routing

Order Routing Connections

Today's trader needs reliable, high-speed access to electronic markets. The CQG Hosted Exchange Gateways provide our customers with low-latency connections to over forty major cash and futures exchanges. CQG manages direct market connections for over one hundred FCM environments, enabling them to focus on core trading operations and customers.

CQG Smart Orders

Each smart order has unique features designed to aid the trader in better order and trade management. Smart orders include:

- DOM-triggered stop/stop limit

- Trailing limit

- Trailing stop/stop limit

- Bracket

- Order-cancels-order

- Study-following order

Integrated Analytics and Order Routing

CQG enables traders to set up pages combining charts, studies, quote displays, and order routing applications. In addition, traders can develop and backtest trading systems and perform options analysis.

- Real-time and historical market data from over seventy-five global sources

- Numerous chart styles, including CQG's exclusive TFlow

- Over one hundred basic and custom studies

- Different styles of quote displays

- CQG News, which displays Dow Jones Newswires, The Hightower Report, MarketG2 News, Market News International

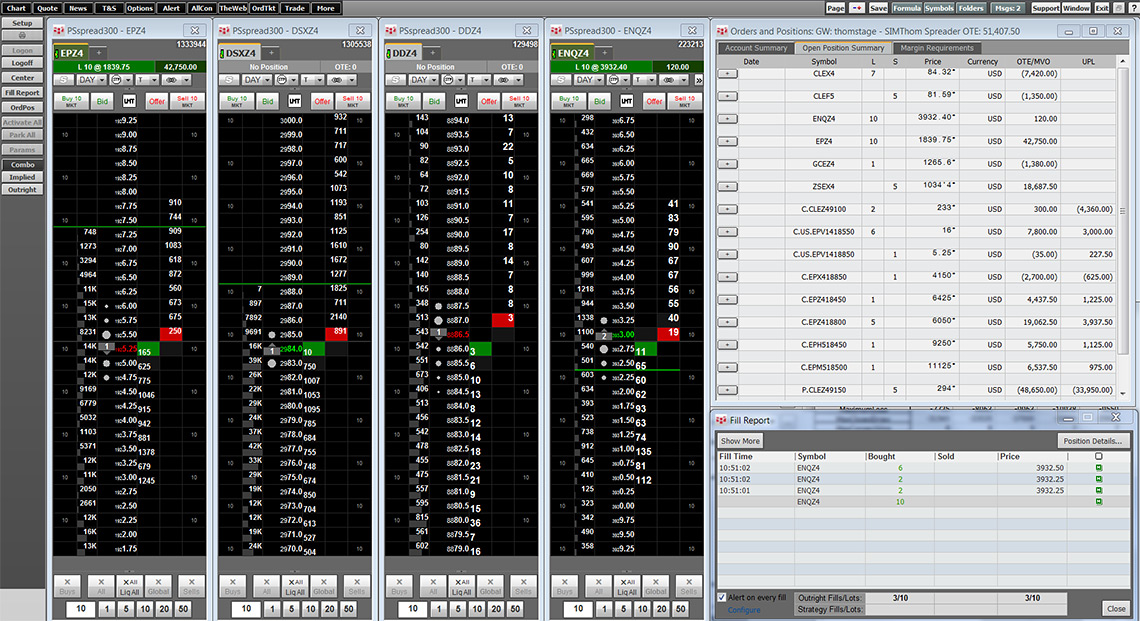

Sophisticated Front-End Trading Tools

CQG's dynamic order routing tools provide key market information. Features include depth-of-market views on price ladders, direct trading from the charts and quote pages, and integration with analytics. Some order entry and management tools and features include:

- CQG Spreader

- Server-Side Aggregation

- DOMTrader

- Spread Matrix

- Spread Pyramid

- Order Ticket

- SnapTrader

- Order Desk

- Spreadsheet Trader

- Quote SpreadSheet

- Enhanced Quote SpreadSheet

- Orders and Positions

- CQG Alerts

Hosted Exchange Gateways

A complete solution for brokerages and FCMs around the world

Global Trading Access

CQG Hosted Exchange Gateways provide your customers with low-latency connections to over forty major futures, forex, equities, and cash treasury markets. CQG manages direct market connections for over one hundred FCM environments.

White-Labeled Front End

Maximize your firm's visibility with CQG Trader white labeling. CQG Trader is a stand-alone order routing application. CQG Trader includes DOMTrader®, Order Ticket, Quote Board, and the Orders and Reports window.

State-of-the-Art Margining

We provide the tools that allow you to manage risk on both an order and account basis. More importantly, we provide superior tools for managing account balances in real time. CQG's risk engine is one of the most advanced in the industry. We maximize your protection by using exchange-published risk arrays in our calculations and determining margin account requirements on the basis of overall portfolio risk (a SPAN®-like calculation*).

Reduced Costs

CQG Hosted Exchange Gateways are a secure, low-latency order routing solution installed and maintained by CQG for our partner clearing firms. Your customers and employees can route orders to the exchanges using CQG QTrader, CQG Desktop, CQG One, or our flagship product, CQG Integrated Client. CQG provides the industry's leading pre-trade and post-trade risk analytics module and an easy-to-use, browser-based Customer Account Service Tool (CAST).

Risk Management

CQG's risk management tools are the most sophisticated and cost-effective in the industry

State-of-the-Art Margining

We provide the tools that allow you to manage risk on both an order and account basis. More importantly, we provide superior tools for managing account balances in real time. CQG's risk engine is one of the most advanced in the industry. We maximize your protection by using exchange-published risk arrays in our calculations and by determining margin account requirements on the basis of overall portfolio risk (a SPAN®-like calculation*).

Flexible Group Accounts

CQG's risk management system allows you to create master accounts with highly flexible subaccounts that share purchasing power, exposure, or both.

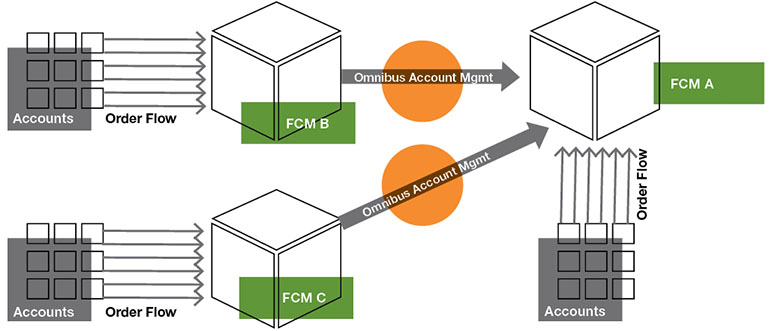

Robust Management of Omnibus Accounts

CQG makes it easy for you to efficiently and securely increase your business by offering non-disclosed account services (omnibus accounts) to non-clearing FCMs. CQG's real-time risk engine can be applied to omnibus accounts with the same speed and effectiveness as to individual accounts. All of the standard risk parameters can be used to manage your omnibus accounts. In addition, your omnibus account client can manage all subaccounts using the same features of CQG's risk management system.

Fast, Cost-Effective, and Real-Time

CQG's risk management system is designed for speed. It is hosted on CQG's servers and adds less than one millisecond to any trade while applying one of the most advanced risk engines. You receive all the cost-effective protection you want, and your traders receive all the speed they need. CQG's risk management system includes the Customer Account Service Tool (CAST), an easy-to-use, browser-based tool for brokers and support personnel to manage accounts and set risk parameters.

Exclusive Route-Based Risk Control

CQG is one of the first in the industry to provide comprehensive, route-based risk management. CQG's route-based solution allows you to establish order and position size control over exchange routes. With multiple routes per exchange, you can manage your exchange exposure. Using route-based risk management allows you to efficiently manage your exchange relationships on an exchange-by-exchange basis.

Risk Based on Working Orders

It is not enough to analyze risk based only upon open positions and the current state of the market. Working orders have the potential to increase risk and must be incorporated into your portfolio's risk analysis. CQG's risk management system makes sure you are never in a position where a customer's working orders have added, unwanted risk.

Risk Settings Available

Pre-trade risk management includes peraccount settings with a margining system for evaluating worst-case scenarios. FCMs can customize account risk settings to:

- Evaluate real-time margin.

- Permit futures and options trading.

- Enable trading on individual commodities.

- Control order size.

- Control position size limits.

- Add a new external position.

- Add a new external order.

- Set liquidation-only mode.

- Enable single trade margin limit.

- Set a daily loss limit percent.

- Set a daily loss dollar amount.

- Set an exchange margin multiple.

- Set an allowable margin credit.

Margin Analysis

The risk management module performs margin analysis using:

- Account balance and equity.

- Open positions.

- Open trade equity.

- Unrealized profit/loss for options.

- Collateral on deposit.

- Net liquidity value.

- Market value of options.

- Accurate historical data.

- Exchange-published risk arrays.

Risk Controls

The risk management module monitors incoming orders. For orders that increase risk, the module can:

- Compute margin for the entire account.

- Use open equity to gauge available funds.

- Always accept liquidation orders.

- Compare available funds required based on exchange margin or FCM parameters.

- Deny orders when funds are insufficient.

- Analyze working orders to check margins.

Account Types

- Single accounts.

- Give-up accounts.

- Group accounts with shared purchasing power.

- Omnibus accounts.

- Commerical accounts.

* SPAN® is a registered trademark of CME Group.